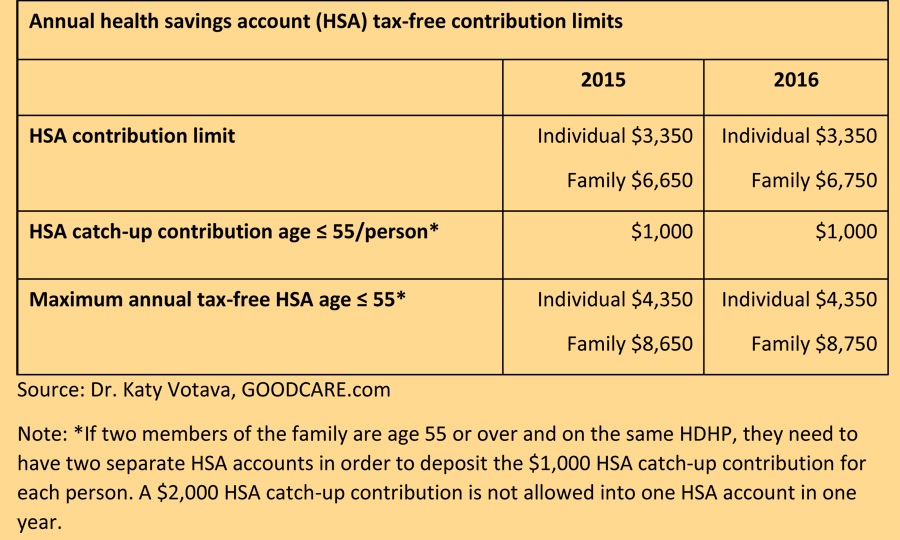

HSAs are actually handled like IRAs in a divorce. The next question was, "How should it be divided?" Neither the advisor nor the attorney had ever encountered an HSA as part of property division, and both were quite surprised at the amount. HSAs and Divorce At first it was hard to believe: A client in the process of divorce came in with a list of family assets, and one of them was a health savings account in the amount of $85,000. Many HSA contributors prefer to allow the accounts to grow for future use rather than using them for medical expenses, so it's not hard to believe that a considerable number of accounts are now worth over $100,000. Contribution limits are indexed for inflation, and the accounts can be invested as aggressively or conservatively as desired. The current HSA maximum contribution for a family is $6,750, and $3,400 for a single person ($4,400 if over age 55). HSA dollars can be used to pay for Part B premiums but not Medicare supplement policies.įunds that are withdrawn and not used for qualified medical expenses are considered to be taxable distributions and are subject to a 20% penalty unless the taxpayer is 65 or older. Medicare recipients can no longer contribute because they are covered by Medicare Part A and cannot qualify for a high-deductible plan. You can continue to withdraw from the HSA plan to cover qualified medical expenses even after you are no longer eligible to contribute, usually due to a change in health insurance plan or hitting age 65. Tax-deductible contributions can be made up to specified annual amounts, there are no income restrictions for contributing, and they must be used in conjunction with a qualified high-deductible health insurance plan. Health Savings Account Basics HSAs are tax-exempt custodial accounts. They may still seem like a new idea, but HSAs have now been with us for 13 years, and some of the balances have become quite large. And so it is with health savings accounts (HSAs). On the guidance repository, except to establish historical facts.Remember when IRAs were a new idea? Then they became mainstream, and then we began to commonly see them as assets to be dealt with in death and divorce.

The Department may not cite, use, or rely on any guidance that is not posted If you need assistance accessing an accessible version of this document, please reach out to the The contents of this database lack the force and effect of law, except asĪuthorized by law (including Medicare Advantage Rate Announcements and Advance Notices) or as specifically We are in the process of retroactively making some documents accessible. HHS is committed to making its websites and documents accessible to the widest possible audience, Where can I get a list of Qualified Medical Expenses?įor a list of services and products that count as Qualified Medical Expenses and for other tax information, view IRS publication #969 for the year that you're filing.

Individual Income Tax Return, and Form 8853 each year to report your Qualified Medical Expenses. How do you avoid tax withdrawals from your account for Qualified Medical Expenses?įile Form 1040, U.S. You'll need to show that you've had Qualified Medical Expenses in at least this amount, or you may have to pay taxes and additional penalties. Qualified Medical Expenses could count toward your Medicare MSA Plan deductible only if the expenses are for Medicare-covered Part A and Part B services.Įach year, you should get a 1099-SA form from your bank that includes all of the withdrawals from your account. Services like dental and vision care are Qualified Medical Expenses, but aren't covered by Medicare. Some Qualified Medical Expenses, like doctors' visits, lab tests, and hospital stays, are also Medicare-covered services. Qualified Medical Expenses are generally the same types of services and products that otherwise could be deducted as medical expenses on your yearly income tax return.

0 kommentar(er)

0 kommentar(er)